Leave a Legacy

The Community Foundation of Southern New Mexico is built on the visions and dreams of the people in southern New Mexico. The Foundation’s Community Legacy Society recognizes people who are making gifts today that will provide significant benefits to our community in the future. A gift can be as simple as including a bequest to the Community Foundation in your will. You may leave a percentage of your estate, specify the dollar amount, or designate the Community Foundation as a contingent beneficiary.

However, planned giving encompasses much more than a simple bequest. With the goals of providing for your loved ones, reducing taxes, and remembering worthy causes, there are a variety of techniques available—with mutual benefit to you and your favorite charitable organizations now and in the future.

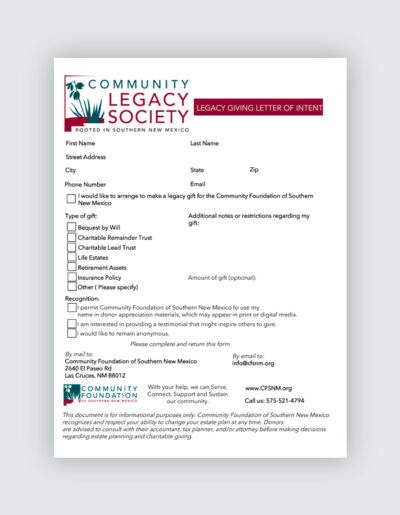

When you include the Foundation in your estate plans or create a life income gift, you qualify to become a member of the Legacy Society and will be included in all Foundation activities. You may choose to have your name listed in our annual report as a Legacy Society member or remain anonymous.

If you’ve already named the Foundation as a beneficiary in your will, qualified retirement plan, life insurance policy, trusts or pooled life income funds, please contact the Foundation so we can appropriately recognize you and ensure that your wishes are met.

Here are several terms to use while speaking to your estate professional:

Bequest by Will: Donors write a will and designate a gift by amount, by percentage of their estate, and/or make it contingent on specific future events.

Charitable Remainder Trust: This type of charitable instrument lets donors place cash or property into a tax-exempt trust that pays them (or another named beneficiary) an annual income. The donor receives an immediate tax deduction for the present value of the gift in the year the gift was made. After death, or at the end of the specified term, the remainder of the trust transfers to the CFSNM.

Charitable Lead Trust: A Charitable Lead Trust (CLT) is the opposite of a CRT. In a CLT, a donor contributes cash or property to a trust that pays either a fixed dollar amount or a fixed percentage of the trust’s assets to the CFSNM for the number of years he/she specifies. Once this period ends, the assets held by the trust revert to the donor for the donor’s estate, or are transferred to beneficiaries named by the donor. Unlike a CRT, a CLT is not exempt from tax.

Life Estates: A donor who makes a gift of a home or farm can opt to give the property outright and receive a tax deduction for the property’s market value, or he/she may choose to retain use of the property for the rest of his/her lifetime through a life estate.

Retirement Assets: A donor must complete a change of beneficiary form provided by the plan administrator.

Insurance Policies: Gifts of life insurance provide a simple way to give a significant gift to charity, with tax benefits that can be enjoyed during one’s lifetime. The donor makes the CFSNM the owner and irrevocable beneficiary of a life insurance policy. The donor receives a tax deduction for the approximate cost or fair market value, whichever is less. If the policy is paid up, the donor receives an immediate tax deduction. If it is not, the donor can claim continuing tax deductions on premium payments the donor makes directly to the CFSNM.